K2 MULTIFAMILY INVESTORS LLC IS A SYNDICATOR OF MID-SIZED APARTMENT COMPLEXES FOR OUR LIMITED PARTNERS SEEKING PASSIVE MULTIFAMILY INVESTMENT OPPORTUNITIES IN THE SOUTHEAST AND SUNBELT.

K2 MULTIFAMILY INVESTORS LLC

MULTIFAMILY REAL ESTATE SYNDICATION

Seeking Limited Partners for Apartment Complex Acquisitions

Welcome to Syndication Bee. K2 MULTIFAMILY INVESTORS LLC (K2MI) is a Multifamily Real Estate Acquisitions and Syndication Firm Seeking Limited Partners for Value Add Apartment Complex Investments in the Southeastern United States and Sunbelt regions. K2MI is headed up by wireless infrastructure leasing expert Steve Kazella. K2MI targets acquisitions of 50+ unit B/C-Class apartment complexes in select cities in Texas, Alabama, Georgia, South Carolina & North Carolina.

We are partnered with a team of experienced underwriters, multifamily investors and syndications attorneys who help us maintain SEC compliance overseeing our Private Placement Memorandums, our Limited Partnership Agreement, and filings. We offer a solid a syndication model for our participating LPs.

ACQUISITION CRITERIA - WHAT WE BUY

K2MI is targeting following types of multifamily properties which fit our acquisition and syndication model:

Apartment complexes built between 1960 - 2015

Minimum requirement 50+ units

Targeted acquisition sized 50-200 units

B/C-Class value-add properties not located in "war zones"

DFW, Austin, San Antonio, Houston, Charlotte, Raleigh-Durham, Asheville, Greensboro, Winston-Salem, Wilmington, Atlanta, Savannah, Athens, Augusta, Charleston, Spartanburg, Myrtle Beach, Columbia, Greenville, Huntsville, Tuscaloosa, Boca Raton, Pensacola.

Multifamily Limited Partner Investment Opportunity

Experienced Leadership. Stephen “Steve” Kazella, with over 20 years of experience in vertical real estate consulting for cell tower landlords, brings a unique perspective to multifamily syndication, informed by extensive work with apartment complex owners.

Strategic Market Focus. Targeting off-market medium-sized (50-200 unit) multifamily B/C-Class properties in Texas, and the Southeast, capitalizing on high-demand, high-potential growth markets.

Innovative Approach. Utilizes next-generation AI-based acquisition systems paired with a conservative syndication model to identify and secure high-value, off-market multifamily assets.

Expert Team. Partnered with a Dallas-Fort Worth-based investor owning over 2,000 apartment units, Texas funding partner, East Coast multifamily transactional attorney who has closed billions in apartment complex purchases, professional underwriters and SEC compliance team, and ensuring a streamlined and informed acquisition process.

Passive Investment Opportunity. Inviting a select group of Limited Partners to invest passively in curated multifamily properties, leveraging Steve’s expertise and network for attractive returns.

Next Steps. Interested investors can sign up with their name and email address to explore this exclusive opportunity further.

STEPHEN ("STEVE") KAZELLA'S BIO

Steve leads K2 Multifamily Investors LLC (K2MI), a Northwest Florida multifamily real estate investment and syndication firm. He is a 1993 Montclair State College (N.J.) graduate (B.S.), cell tower landlord advocate - wireless leasing expert, fluent Hungarian speaker and purpose-driven multifamily investor.

Multifamily Investor: K2MI focuses on delivering value to Limited Partners and quality housing for tenants. Steve's partnered with a top-tier acquisition, underwriting and legal team along with a close network of purposeful multifamily investors owning thousands of U.S. apartment units.

Cell Tower Industry Leader: Founding Partner at Tower Genius, a top U.S. wireless leasing consultant. Featured in the New York Times, in Christianity Today, Realtor Magazine and many others. Since 2000, worked has worked with Sprint, T-Mobile, Verizon, and advised Wall Street banks, REITs and utilities. Since the 1990s, Tower Genius partners have overseen the acquisition, leasing and development of over 10,000 cell sites and towers, exceeding $11.5 Billion in leased value. Supported FEMA and Verizon post-9/11 with 36 emergency Cell on Wheels (COWs) deployments in lower Manhattan.

Core Values: Honesty and integrity throughout every apartment complex acquisition. The driving force behind Steve's career is the above-mentioned quote from friend and former colleague, Millard Fuller, "People deserve a simple, decent place to live." It has motivated Steve in his wireless consulting work throughout his career, and is the core value in his multifamily acquisitions endeavors.

Global Housing Advocate: Early in his career, Steve Partnered with President Jimmy Carter and Habitat for Humanity’s CEO Millard Fuller to launch Hungary’s first Habitat affiliate. He spearheaded the 1996 Carter Project "Blitz Build" in Vác, Hungary, building 10 homes in 7 days with 500 volunteers.

Local Vision: Still, some of the most exciting times of Steve's career were sitting in conference rooms in 1995 in Americus, Georgia with Millard Fuller, President Carter and other Habitat Executives as a 26-year old giving insights to Habitat leadership and a former U.S. President on the day to day operations in Hungary, planning of the upcoming build, and laying out future plans for the Hungarian affiliate after the 500 American volunteers returned to the United States.

Global Impact: Twenty-nine years later, Habitat is thriving in Hungary, since 1996, HFHI Hungary has built over 150 homes, renovated nearly 800 dwellings, offered technical counseling to 700 families, and provided household management and training programs to 1,100 people, impacting 2,700 families overall.

What is real estate syndication and what makes it attractive as an investment?

Real estate syndications are the investment vehicle of choice for many true passive investors who want to invest in multifamily real estate without having to swing a hammer. You can participate in contributing capital to fund all, or a portion of the funds needed to complete the acquisition of one of our multifamily properties which is under contract. Register on the form at the bottom of this page to be notified of upcoming multi unit real estate investing Limited Partnership opportunities.

Multifamily syndications fall under SEC rules, mainly Regulation D, Rule 506(b) or 506(c).

· Rule 506(b): Open to both accredited and non-accredited investors (up to 35 non-accredited).

· Rule 506(c): Only for accredited investors, with verified income or net worth. More common for bigger deals due

to simpler rules.

· Regardless of whether you are an Accredited or aNon-accredited investor, our attorneys will ensure our firm stays transparent and compliant with SEC Regulation D, Rule 506(b) or 506(c) and prepare the PPM (Private Placement Memorandum) and all other associated materials.

K2 Multifamily Investors LLC (K2MI), a Florida-based multifamily investor and real estate syndicator, simplifies investing in multifamily real estate through our multifamily real estate syndication model, offering stable cash flow, long-term appreciation, and tax benefits to Accredited Investors and to non-Accredited investors through professionally managed, income-generating apartment complex properties.

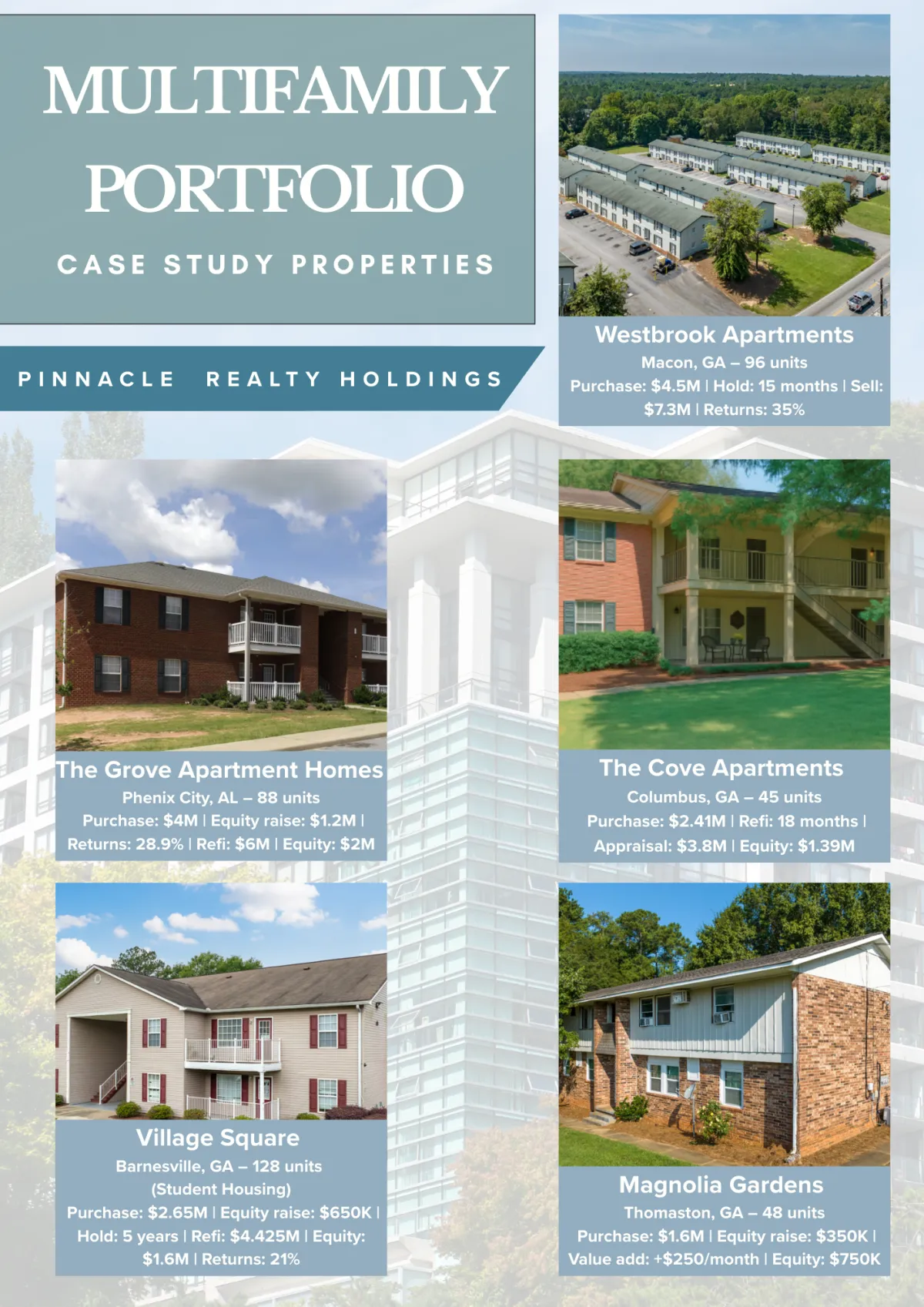

Our seasoned acquisition team identifies and acquires local undervalued multifamily assets, performs light refurbishment to force appreciation, with the goal of delivering value to our passive investor Limited Partners.

Your Local Southeastern "We Buy Apartments" Multifamily Syndicator

K2MI's Multifamily Passive Investment Opportunity Summary

Experienced Leadership: Steve Kazella, with 20+ years in vertical real estate, leads multifamily syndication.

Strategic Market. Targets off-market Class-C/B, 50-200 unit properties in high-demand DFW Metroplex and Southeast.

Innovative Approach: Uses AI-based systems and conservative syndication principles for high-value asset acquisition.

Passive Investment: Invites both accredited and non-accredited Limited Partners to invest in curated properties.

Are you thinking about investing in multifamily real estate, becoming a Limited Partner or seeing our passive investment opportunities in small to mid-sized apartment complexes in the Southeastern United States? Please fill out the Registration Form below to sign up to receive Our Multifamily Syndicator e-Blast where you'll be notified of new multifamily syndications. Open to accredited and non-accredited investors alike, find out more about passively investing in multifamily real estate with K2MI.

REGISTER BELOW FOR OUR

MULTIFAMILY SYNDICATOR E-BLAST

Get Ready To Invest in Multifamily Real Estate!

We Want to Talk to You About Your Interest in Apartment Complex Syndication.

Please Complete and Submit this Secure Form to Register for Our Multifamily Syndicator E-Blast:

Shipping Address:

K2 Multifamily Investors LLC

Attention: Stephen Kazella

4771 Bayou Blvd. #228

Pensacola, Florida 32503

Phone: 850-400-4300

Privacy Policy - Terms of Use